Researchers at City University of Hong Kong (CityUHK) have developed a data-driven machine learning model for financial asset pricing. Designed to be clearer and more efficient than traditional methods, the “P-Trees” model helps investors make better-informed decisions by simplifying complex market data.

The study, “Growing the efficient frontier on panel trees,” was published in the Journal of Financial Economics, a top-tier publication in the field. The research team, led by Professor Feng Guanhao and Professor He Jingyu, utilised AI to improve both the predictive accuracy and the interpretability of portfolio construction.

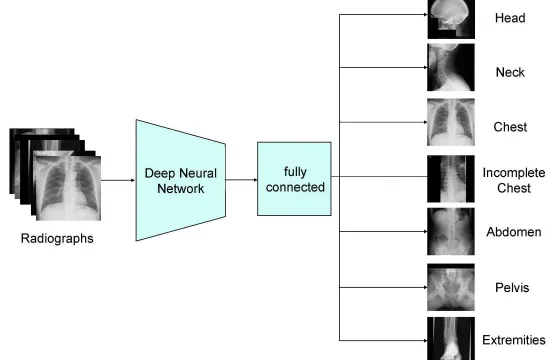

The project was a collaborative effort within the College of Business, involving the Department of Economics and Finance, the Department of Decision Analytics and Operations, and the Research Centre of Fintech and Business Analytics. Working alongside an international team, the researchers designed P-Trees to analyse individual asset returns by generalising high-dimensional sorting—a method that provides strong economic guidance rather than acting as a “black box”.

Under the standard mean–variance efficient frontier framework, the P-Trees model constructs test assets that outperform commonly used benchmarks. Traditional models often struggle to account for the wide range of factors that influence market performance, which can make it difficult for investors to identify optimal opportunities. P-Trees solves this by efficiently sorting through complex data to create more effective portfolios, allowing users to better assess potential returns while reducing decision-making risks.

“Our research suggests that investors should diversify across different asset types and sectors to manage risk effectively,” said Professor Feng. “With the P-Trees model, various factors can be analysed quickly to provide a clear view of potential risks and rewards.” Following his work in AI finance, Professor Feng was recently elected as a research fellow at the Asian Bureau of Financial and Economic Research (ABFER).

A key feature of the model is its ability to adapt to changing economic conditions. This allows investors to adjust their strategies in real-time, helping them stay ahead of market trends through a structured analysis of asset performance.

Professor He noted that the model’s benefits extend beyond institutional use. “We believe P-Trees can change how portfolios are managed, benefiting both financial experts and everyday investors,” He said. “It is a tool that helps people make more informed decisions when building their portfolios.”

The research offers a critical takeaway for students and professionals navigating the shift toward AI and big data: future competitiveness in finance depends on the ability to blend advanced machine learning with sound economic theory. The researchers believe P-Trees serves as a practical guide for the next generation of talent, demonstrating that even as decision-making becomes more automated, the most effective strategies are those that remain transparent, interpretable, and grounded in human insight.